When considering condos, you may notice that the listings discuss an HOA and the fees (which are also called dues) that the HOA charges. Before buying, read these insights on what HOA fees are and how they will work on behalf of a condo owner.

What is an HOA and why do they charge condo fees?

When you purchase a condominium, or condo, you’re buying a private unit within a larger complex with shared, jointly owned areas. Condo complexes usually have an HOA, or homeowners’ association, which manages the upkeep of the community, including the building’s exterior and common areas. To pay for this upkeep, the HOA charges all residents a monthly or annual HOA fee.

What are the HOA dues used for? HOA coverage varies from one community to the next, but it’s typical for HOA fees to cover the building’s exterior and common areas — such as the secure entry points and lobby, elevators, garages and parking lots. The HOA may also organize and pay for services like:

- Water, electricity and heat (in common spaces or in all units)

- Waste management

- Property management

- Snow plowing and landscaping

HOA fees would also likely cover the upkeep of any shared amenities and areas within the complex, including:

- Tennis courts

- Pools, hot tubs or saunas

- Fitness rooms and equipment

- Outdoor patios and grilling equipment

But HOA fees don’t just cover the building’s general upkeep and services, they are also intended to pay for larger maintenance projects that are needed as the property ages. The HOA will reserve a portion of the fees and create an approved schedule for large-scale projects like new siding, roofing repairs and other structural maintenance. These reserves may also be used for emergencies or unexpected, but necessary, repairs.

As a condo owner, you want to be reassured that your property will maintain as much value as possible over time, so you’ll want to be sure that your condo’s HOA has money on reserve for such future projects and emergencies.

Last, the HOA dues cover insurance secured by the HOA. HOA insurance varies in its complexity and coverage but the most common policy is “studs-out,” which covers general incidents and damage occurring outside the walls of the condo’s units. The HOA insurance policy will have a deductible (sometimes a significant one) that may be passed on to the unit owners.

Keep in mind that as an individual condo owner, you’ll have to secure your own homeowners’ insurance to ensure coverage within your condo unit. You may add coverage to your own policy that will pay for your share of the complex’s deductible, if the need arises.

What is the typical cost of an HOA fee?

Condos can be an affordable option for a first-time buyer, or they can be a high-end luxury property worth more than a mansion in the suburbs. And just as condo values vary, so too do their associated HOA fees.

Typically, you can expect that the HOA dues for a condo will be between 25 cents and 75 cents per square foot per month.

How are HOA fees determined? Can I negotiate my HOA fee down?

Your HOA fee is usually determined based on your percent of ownership in the complex. But you shouldn’t assume that by living in a complex with ten units, you automatically have 10 percent of the ownership.

Your HOA may determine your ownership based on a number of variables including, but not limited to, your:

- Square footage

- Floor or view

- Floor plan

- Sales price or assessed value

As a condo owner, you won’t be able to negotiate your HOA fee down; it is pre-set by the HOA and you are expected to pay it. If you disagree with the amount your HOA is charging, you can consider joining the HOA and advocating to change contracts or service agreements in order to (potentially) bring down everyone’s HOA fees.

What happens if I don’t pay my HOA fee?

If you stop paying your HOA fees, the HOA will take a series of steps to recoup their money. Every HOA is a little bit different, but it’s common for them to escalate their response over time.

In response to late payments or lapsed payments, your HOA may:

- Send a letter requesting the late payment

- Charge a late fee or interest

- Cut you off from shared amenities

- File a lien on your property

- Foreclose the lien and take ownership of the unit

What happens to the HOA fees if a condo goes into foreclosure?

If a condo unit goes into foreclosure, the owner often stops paying their HOA fees. Those fees don’t just go away; the HOA will still take measures to recoup them as the property goes through the foreclosure process. If the property is being taken over by the bank, the bank is then responsible for paying for a portion of the missed dues or negotiating a set amount with the HOA.

How can I factor in HOA fees when buying?

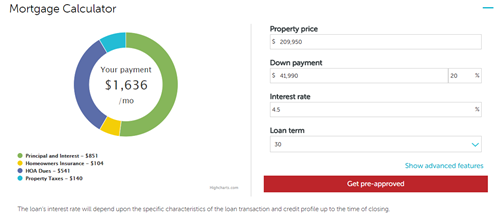

Because you’ll pay your HOA fees on a regular schedule — usually monthly or annually— you should consider the fees within your buying and owning budget. When searching condos on edinarealty.com, you can calculate your monthly costs for each condo you consider, including:

- Mortgage principal and interest

- Homeowners insurance

- Property taxes

- HOA fees or dues

You can adjust important factors like your down payment amount and interest rate to help you budget appropriately and prepare for the known costs of homeownership in advance. This mortgage calculator is available on every property detail page on edinarealty.com:

Key points and next steps

If you’re thinking of buying a condo, pay attention to the HOA and the fees it charges each month. Be sure to consider:

- How much you’ll pay in HOA fees

- What the HOA fees cover

- How much the HOA has in “reserve” for future projects and emergencies

- If you’ll be able to responsibly pay your HOA dues without hardship

If you’re ready to speak with a Realtor about touring condos in your desired area, reach out to Edina Realty’s customer care team. They’re able to match you with a condo specialist seven days a week.

©2025 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at

©2025 Prosperity Home Mortgage LLC®. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC®. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at